Get the full picture of healthcare claims for any sized group

Confidently advise clients and provide better-matched plans with the claims insights you need.

Benefit spend comes into crystal clear focus with Beacon

Forget basic demographic models, time-consuming questionnaires, or flawed self-reported health surveys.

Instead, access a real healthcare claims data assessment for any employer group and provide better-matched plans for your clients based on their employee population’s unique healthcare claims data.

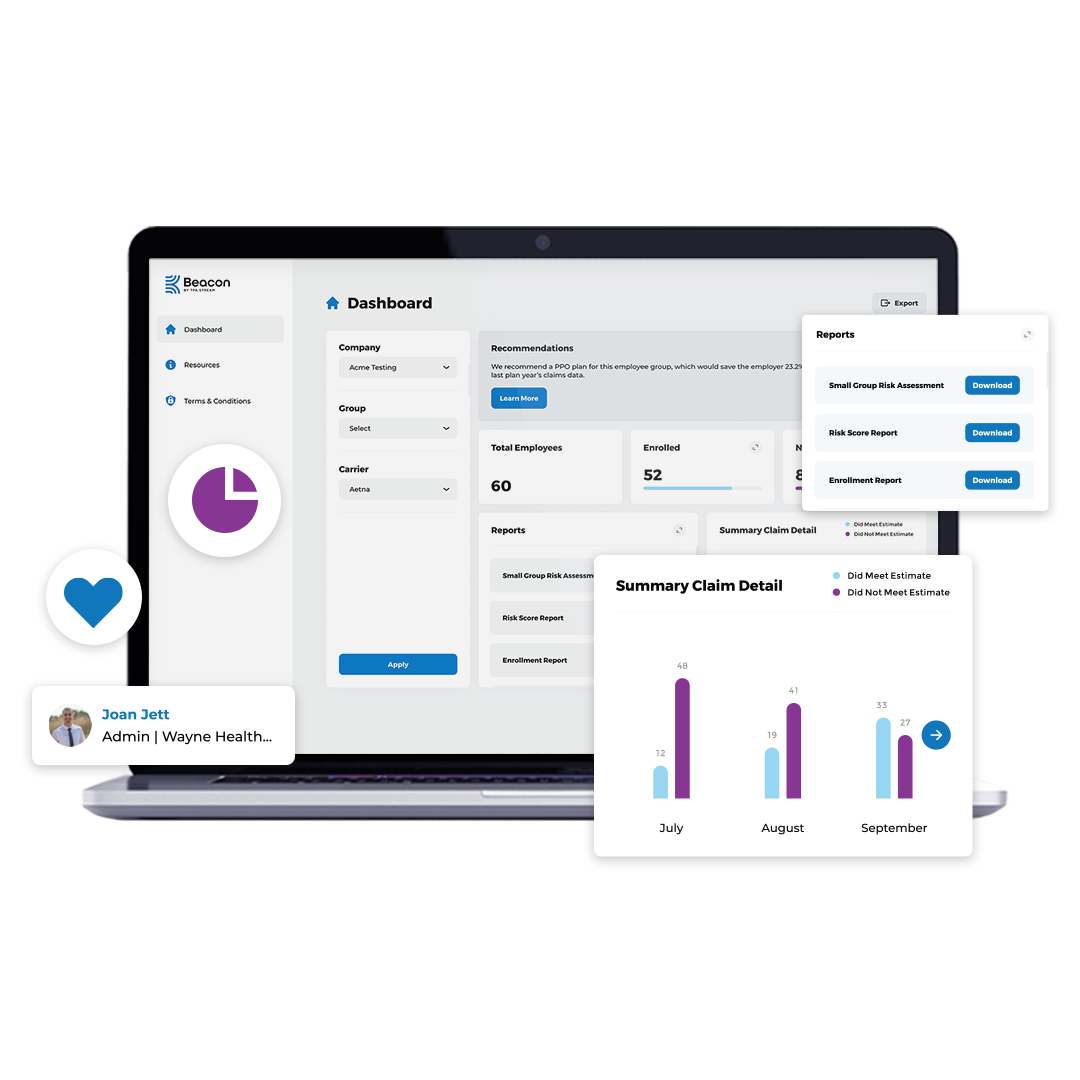

Intuitive Dashboards for you and those you advise

- Quickly view enrollment levels

- Get insights about plan utilization

- Discover high risk populations for more accurate plan creation

- Drive employee engagement instantly

Get an accurate assessment for any employer group based on their actual claims data.

We help you tackle your client's biggest issues like rising costs, labor-intensive open enrollment, and lack of transparency in plan use.

Clear & Insightful Reports

Working with some of the country's leading brokerages, we've built claims reports designed to help you advise your small group clients.

Reports

Go beyond just the data with insightful reports that help you confidently recommend and tailor plans to the unique needs of the employer group, and secure stop-loss insurance.

- Small Group Risk Assessment which includes the top twelve factors underwriters want to see

- Line level claim detail report

- Summary claim detail report

- High-risk summary report

- Medical costs report

- Prescription cost report

- In-Network vs. Out-of-network report

- Total number of enrolled

- Total number of unenrolled

- Total group demographics report

- Plus, download the data directly for further analysis

Data Points

We securely harvest data from the employee's EOB and claims statements including:

- Date of service

- Type of claim

- In-Network vs Out-of-network

- Provider

- Deductible usage

- Amount billed

- Amount allowed

- Amount paid

- Patient responsibility

- Copay

- Coinsurance

- Deductible

- Prescription information

Get a clear picture fast.

In less than a pay period, you can have detailed insights you need to confidently plan. Beyond that, the data can be exported to 30+ systems or downloaded directly.

01

Employer connects

We make employer onboarding easy with our proven Employer Success Kit. And once they're connected, they'll love using the product, too. We make it easy for employers to track enrollment and provide benefit utilization reports they've been asking you for.

02

Employees enroll

Employees are automatically notified and prompted to enroll and provide access to sync their claims data. We're experts in driving enrollment to get you the most accurate picture possible and their data is always secure.

03

We harvest claims

EOBs and data are securely housed in a HIPAA-compliant, SOC II Type 2 database. Using our proprietary data standardization methods and claims software, we start crunching the numbers the instant we have a connection.

04

Get the insights

Go beyond the data with insights designed to drive smart decision making and plan creation. Best of all, we'll provide you a specialized report for underwriting, designed in tandem with leading underwriters so they can provide stop-loss insurance.

About TPA Stream

TPA Stream is a healthcare software company headquartered in Cleveland, Ohio. Founded in 2014, TPA Stream’s web-based platform services brokers, third-party administrators, health plans, and financial institutions to streamline efficiencies across all aspects of employee benefits administration. Company solutions include Claims Harvesting, Employer Invoicing, and Claims & Enrollment integrations that connect directly with benefit administration systems, saving time, improving accuracy, and ensuring easier access to employee health benefits.

FAQs

Is the participant data secure?

TPA Stream’s secure cloud is HIPAA-compliant, and all data is encrypted both in transit and at rest. All employees go through comprehensive background checks, and our internal processes are regularly monitored and audited. You can learn more here.

How do I get more information?

Let's set up a call to understand your needs. You can request a demo by completing the form below.

What is the implementation process?

Implementation is really simple. Within a week, you'll be set up from a technical standpoint and ready to collect claims. We provide marketing resources that are proven to generate a high rate of employee enrollment including emails that you can brand, a recommended cadence, and info for your clients. Once enrollment concludes, you're all set.